According to a report released by Google, Temasek and Bain, the digital economy in Southeast Asia is expected to generate about $100 billion in revenue by 2023, despite the slowdown in economic growth in the region. Digital payments account for more than 50% of the total transactions in the region. This growth is mainly driven by the continuous development of the e-commerce industry in Southeast Asia. In addition, the tourism sector also shows significant signs of recovery, and its performance is expected to increase by about four times, surpassing the previous five years. However, compared with the historical high of $2.7 billion in 2017, the private financing of digital enterprises in Southeast Asia is expected to drop to the lowest level since 2021.

Southeast Asia: A Hotbed for Various Types of Cyber Fraud

There is a certain degree of economic imbalance in Southeast Asia. Singapore is a developed region, where 98% of the population use banking services. However, in underdeveloped regions such as Indonesia, Vietnam, and the Philippines, only about 30% of the residents have bank accounts, and some have never been exposed to traditional financial services.

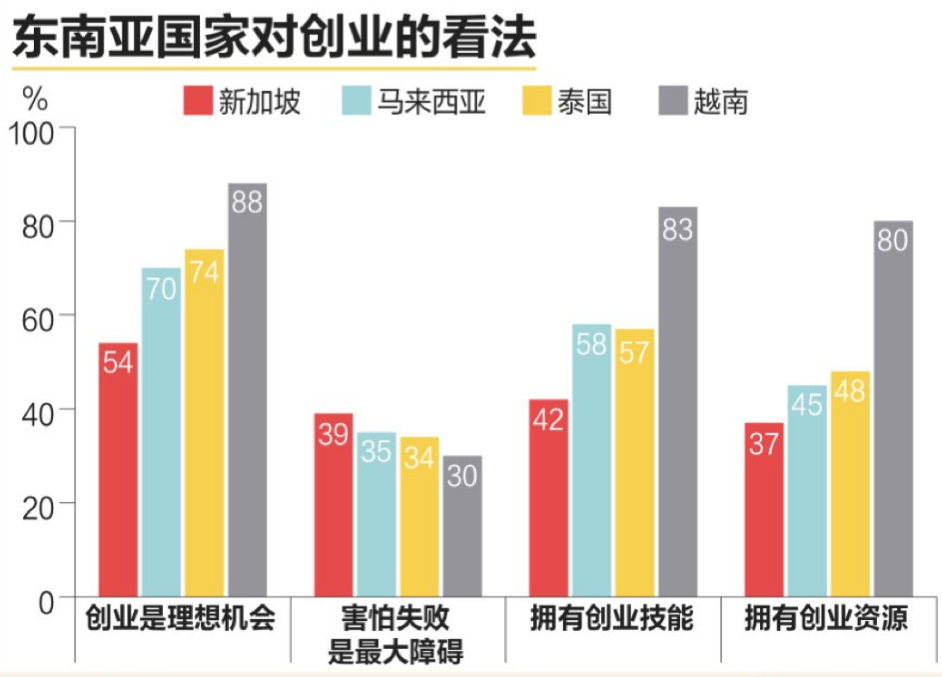

Compared with other developed regions, Southeast Asia has been called a "breeding ground for fraudsters" due to the frequent occurrence of online fraud, financial fraud and related criminal activities. On the one hand, most countries in the region have relatively late development of modern financial systems, and the deployment efficiency of related identity verification infrastructure and digital credit anti-fraud systems is low, making risk management difficult and the overall risk management system fragile. On the other hand, local residents generally lack awareness of credit and financial knowledge.

Analysis shows that Southeast Asian enterprises face two major risks: identity fraud risk and financial credit risk.

In terms of identity fraud, Indonesia, Vietnam and Thailand are the most affected countries. These countries have a large online consumer population, and their mobile phone penetration rates rank among the highest in the world, but most people lack awareness of digital fraud risks, and the local digital credit infrastructure is imperfect, resulting in high anti-fraud costs for related industries.

In terms of financial credit risk, various industries in Southeast Asia generally face liquidity risk, which is caused by the economic recession and high unemployment rate triggered by the COVID-19 pandemic. This economic downturn has led to a reduction in corporate investment and a decline in external demand, which has put many enterprises in trouble and even faced the risk of bankruptcy. Many borrowers are unable to repay their debts on time. At the same time, some fraudsters use fake identity documents or other false information to apply for loans to obtain improper benefits. This behavior not only causes losses to financial institutions, but also poses a threat to the stability of the entire financial system.

In addition, due to the popularity of mobile internet, the expansion of young consumer groups and the increase of local residents' disposable income, e-commerce industry is one of the industries with the highest digital fraud rate in Southeast Asia. According to a security alert issued by Vietnamese regulators earlier, there are 24 types of fraud on Vietnamese e-commerce platforms, such as selling counterfeit and inferior goods, using other people's identity information for loans, account theft fraud, etc. At the same time, video call fraud using deepfake and deepvoice technologies is also becoming more and more rampant.

Technology: Using Technology to Prevent Fraud

To cope with the risk of fraud in Southeast Asia, it is necessary to strengthen financial education, improve identity verification infrastructure, enhance cooperation and regulation, and promote the application of digital technology to improve risk management and prevention capabilities.

Dingxiang Defense Cloud Business Security Intelligence Center believes that accurately identifying user identity and effectively verifying credit are common challenges faced by various industries in Southeast Asia. Experts suggest that for fraud prevention, accurate identification, effective defense and continuous evolution are needed.

Accurate identification is the key. By using external phone number risk scoring, IP risk library and proxy email detection tools, malicious phone numbers, IP addresses and emails can be detected in time, and at the same time, malicious devices can be detected by checking the legitimacy of device fingerprints and the risks of injection, hook and emulator.

Effective defense is necessary. Build a risk control system that combines machine learning and rule-oriented methods with Dingxiang Defense Cloud and Dingxiang Dinsight. Through multi-dimensional and in-depth analysis, it can accurately identify abnormal operations and perform user depth profiling, and perform big data matching. Detect suspicious operations in time, assess risks, and track and block various fraudulent behaviors.

Continuous evolution is crucial. Based on business data and risk control data, establish a local list dynamic operation and maintenance mechanism, precipitate and maintain corresponding black and white list data, and update risk control strategies in time. At the same time, use Dingxiang xintell intelligent model platform to build exclusive risk models, mine potential risks and improve the security level of social media.

Fraud Prevention: Four Things Businesses in Southeast Asia Need to Consider

Due to the uneven economic development and related social and technical factors in Southeast Asia, Dingxiang Defense Cloud Business Security Intelligence Center recommends strengthening work in the aspects of close to the industry, understanding risks, conforming to local characteristics, and continuous security operations, in order to improve the security defense capabilities of various industries in Cambodia and promote their sustainable and healthy development.

1. Close to the industry. Since different industries have different business characteristics and application environments, understanding the processes and characteristics of each industry is a prerequisite for effective defense. A deep understanding of the business scenarios of the industry can more accurately analyze risks and respond to threats.

2. Understand the risks. Southeast Asia faces various forms of fraud, and attackers show a professional, industrialized, and organized posture. Understanding the tools, paths, and intentions of the black and gray industry chain can help build attacker profiles, thereby responding in a timely manner and promoting the initiative of defense. In addition, a deep understanding of attack techniques is also the key to developing effective security defense solutions.

3. Conform to local characteristics. For the Southeast Asian market, it is necessary to adjust the digital experience according to the language, culture, and needs of local users, and adopt localized strategies. Deploying artificial intelligence anti-fraud solutions with localized strategies can improve fraud identification capabilities, better manage risks, and promote business development. The feasibility of having a localized strategy requires a deep understanding of the local situation and combining macro development trends with local market needs.

4. Continuous security operations. Since risks are constantly changing, continuous security operations are essential. Timely understand and adapt to new security threats, and keep updating and evolving, in order to effectively defend against attacks.